Investment Philosophy

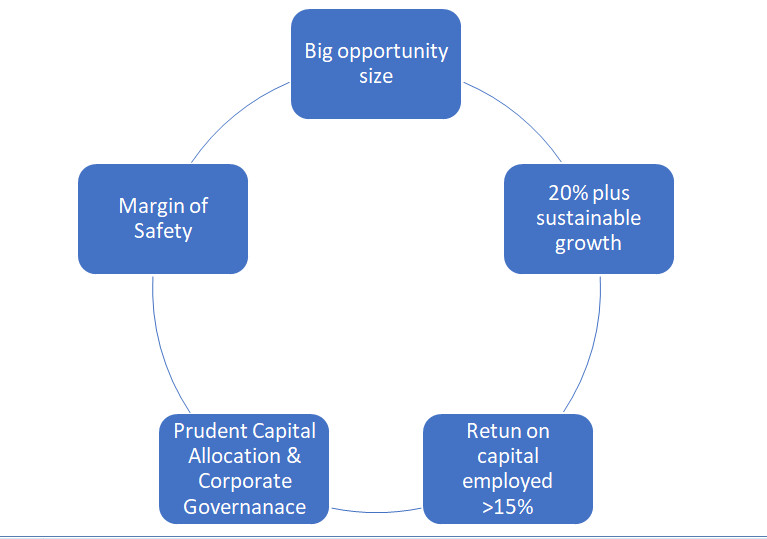

Our approach is to identify companies which have a strong business model, some sort of competitive advantage and the ability to grow by gaining market share and delivering superior returns on capital employed.

Investment Criteria